Welcome to Skolem Segments, a newsletter where our team shares updates to the business and interesting DeFi opportunities and developments. If you're new here, we're excited to welcome you to our Segments for our monthly updates.

Skolem Announcements

- In last month's update, the Skolem team shared that we now support Arbitrum, Polygon, and Avalanche on our platform. Clients and Skolem users can conduct transaction execution, token swaps, TWAPs, WalletConnect transactions, and pre-transaction simulations (for WalletConnect v2.0 protocols) on our supported chains!

- Skolem is excited to announce that we now support WalletConnect v2.0! The WalletConnect v1.0 protocol was shut down on June 28th, 2023 at 2pm UTC, meaning dapps and wallets should be migrating to v2.0 as soon as possible. Read more about the update in our blog here.

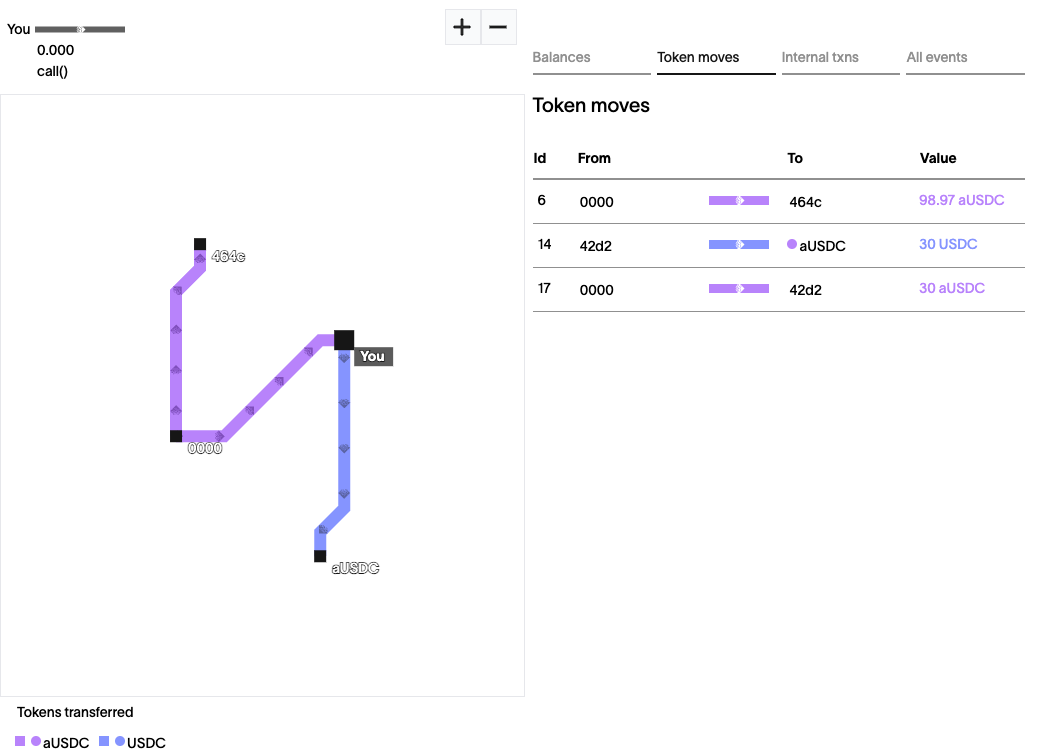

- Skolem’s pre-transaction simulation now provides sophisticated visualizations for relevant actors, asset moves, and smart contract interactions for WalletConnect v2.0 and resembles a subway map for our clients’ ease of use. Check out the simulation for supplying 30 USDC to the AAVE v2 USDC market below! Note: funds are flowing to the AAVE collector as well, hence the third leg, which you would not have seen without the simulation of the transaction.

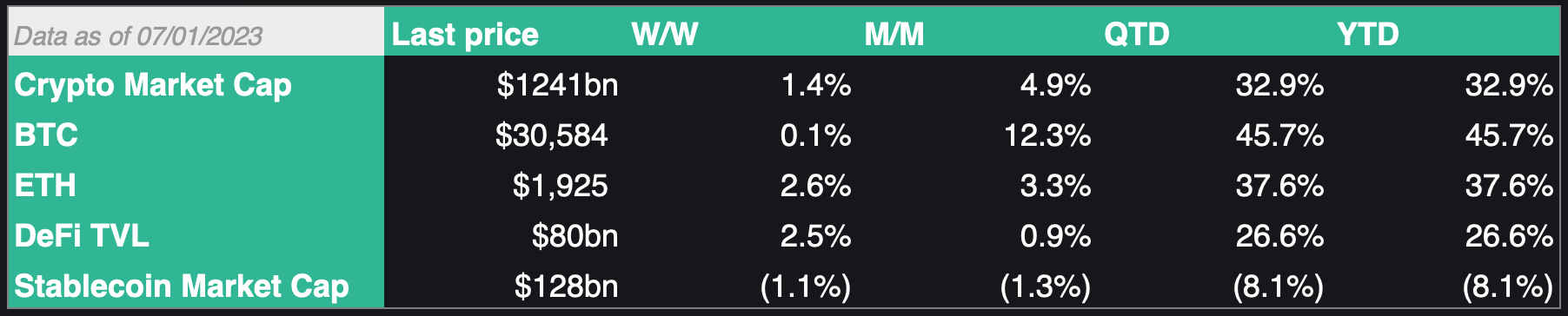

State of the Market

DeFi Yield Opportunities

These are some of the most interesting new yield opportunities surfaced by the Skolem team.

Any information covered in Skolem Segments should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions. Any mention of a token or protocol should not be considered a recommendation or endorsement.

[AURA, ETH] 36% APY with AURA and ETH by depositing Balancer LP tokens (BPT) on Aura Finance

- Yield is earned AURA, BAL

- Deposit AURA and ETH in 50-50 ratio in the 50WETH–50AURA Balancer pool

- Stake BPT tokens received from the Balancer pool into the Aura Finance pool to receive AURA in addition to Balancer’s native rewards

- Risk: Smart contract risk exists for Balancer and Aura Finance smart contracts; AURA and BAL are also volatile tokens and are subject to price risk

[CRV, cvxCRV] 20% APY with cvxCRV-CRV LP tokens by depositing cvxCRV-CRV LP tokens on Convex Finance

- Yield is earned in CRV, CVX

- To participate, first convert some CRV to cvxCRV by staking CRV on Convex Finance (learn more about staking CRV on Convex here)

- Deposit CRV and cvxCRV in the cvxCRV-CRV pool on Curve Finance and then stake CRV and cvxCRV-CRV LP tokens on Convex Finance

- Risk: Smart contract risk and liquidity risk from staking CRV exists as you may not convert cvxCRV back to CRV; secondary markets exist to allow this exchange

[CRV] 20% APY with CRV by depositing CRV on Stake DAO

- Yield is earned in 3CRV, CRV, SDT, and vote incentives for sdCRV

- Deposit CRV, mint sdCRV, and stake them in the gauge on Stake DAO

- Risk: Smart contract risk exists for Stake DAO contracts; SDT and CRV are volatile tokens and are subject to price risk

[crvUSD] 17% APY with USDC by depositing USDC on Conic Finance

- Yield is earned in CRV, CVX, and CNC

- To participate, deposit crvUSD into the crvUSD Omnipool in “Conic Omnipools”

- Risk: Smart contract risk exists for Conic Finance; CRV, CVX, and CNC are volatile tokens and subject to price risk

[ETH] 10% APY with ETH by depositing ETH on Pendle Finance

- Yield is earned in stETH, PENDLE

- Deposit ETH in the ETH Pool and select the 25 Dec 2024 maturity

- Risk: Smart contract risk exists for Pendle smart contracts; PENDLE is also a volatile token and is subject to price risk

[GLP] 25% APY with GLP by depositing GLP on Pendle Finance

- Yield is earned in GLP, PENDLE, SY tokens

- Deposit GLP in the GLP Pool and select the 27 Mar 2024 maturity

- Risk: Smart contract risk exists for Pendle smart contracts; PENDLE is also a volatile token and is subject to price risk

DeFi Developments

Institutional Adoption

- BlackRock applies for a spot Bitcoin ETF - the world's largest asset manager has only had one ETF application rejected... out of 576

- SEC says spot BTC ETF filings from BlackRock, Fidelity, and others are inadequate

- Fidelity, WisdomTree, VanEck, Invesco/Galaxy have re-filed their spot BTC ETF applications

- Volatility Shares unveiled first US-listed leveraged Bitcoin ETF (2x Bitcoin Strategy ETF) and launched on Tuesday, June 27

- SAP is testing cross-border payments using Circle's USDC stablecoin

- Soros Fund Management CEO says crypto is ripe for TradFi takeover, especially as the recent tumult provides an opportunity for entry

- EDX Markets, a noncustodial exchange backed by Citadel, Fidelity, Charles Schwab starts operations in June

- Circle names Heath Tarbert, former Chief Legal Officer at Citadel Securities and 14th chairman of the CFTC, as Chief Legal Officer

- Puma launches Black Station metaverse experience

- Animoca partners with Mitsui through undisclosed investment from the Japanese conglomerate, signaling increasing Web3 adoption in Japan

Regulatory

- SEC sues crypto exchange Coinbase in NY Federal court, claiming Coinbase acted as unregistered broker and alleging basket of coins (SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, NEXO) are securities

- WSJ: Because Coinbase made the tokens above available for trading, and because the SEC alleges they are securities, the company was required to register as an exchange, broker, and clearing agency

- SEC anticipates it will take 120 days to respond to Coinbase's request for rulemaking on digital asset trading

- SEC sues Binance and CEO CZ for breaking securities rules and flouting basic KYC rules

- Binance US suspends USD deposits and prepares to pause fiat withdrawal channels as early as June 13

- WSJ: SEC alleges overseas company operated an illegal trading platform in the U.S. while also misusing customers' funds

- SEC quotes Binance's Chief Compliance Officer (Samuel Lin) saying in 2018, "we are operating as a fking unlicensed securities exchange in the USA bro."

- Binance lawyers allege SEC Chairman Gary Gensler offered to serve as advisor in 2019

- Fed Chairman Jerome Powell argues the need for strong central-bank oversight in stablecoin regulations being crafted by the House Financial Services Committee

- Prime Trust temporarily halted deposits and withdrawals of fiat and crypto after receiving order from Nevada Financial Institution Division

- FID issued Prime Trust a cease-and-desist alleging the firm was effectively insolvent and would be unable to meet customer withdrawals

- FID alleges Prime Trust lost access to legacy wallets in 2021 and used customer assets to buy back crypto

- Binance under investigation by French authorities for alleged illegal provision of crypto services and "aggravated money laundering"

- Deutsche Bank seeking regulatory approval to operate custody service for digital assets

- KuCoin introducing mandatory KYC procedures for all customers starting July 15

- Case against DeFi saving app PoolTogether dismissed

- DOJ charges two Russian nationals with conspiring to launder ~647k Bitcoins from Mt. Gox hack

- ParaFi, Framework Ventures, and 1kx sue Curve Finance founder Michael Egorov and claim that Curve founder Michael Egorov was involved in misappropriation of trade secrets

Contact Us

If your team is interested in reaching out to the Skolem team, please email us at sales@skolem.com or reach out on our website at skolem.com.