Welcome to Skolem Segments, a newsletter where our team shares updates to the business and interesting DeFi opportunities and developments.

Skolem Announcements

- Skolem is ecstatic to share that we now support a select number of Layer-2 blockchains! If you’re interested in executing with our platform on Avalanche, Arbitrum, or Polygon, please contact us at sales@skolem.com! If your team is interested in any other L2s that are currently not supported, please reach out.

- The Skolem team is also excited to share that we have added a new execution feature to enable swaps between wrapped and unwrapped native currencies (e.g., WETH and ETH, WMATIC and MATIC, WAVAX and AVAX)!

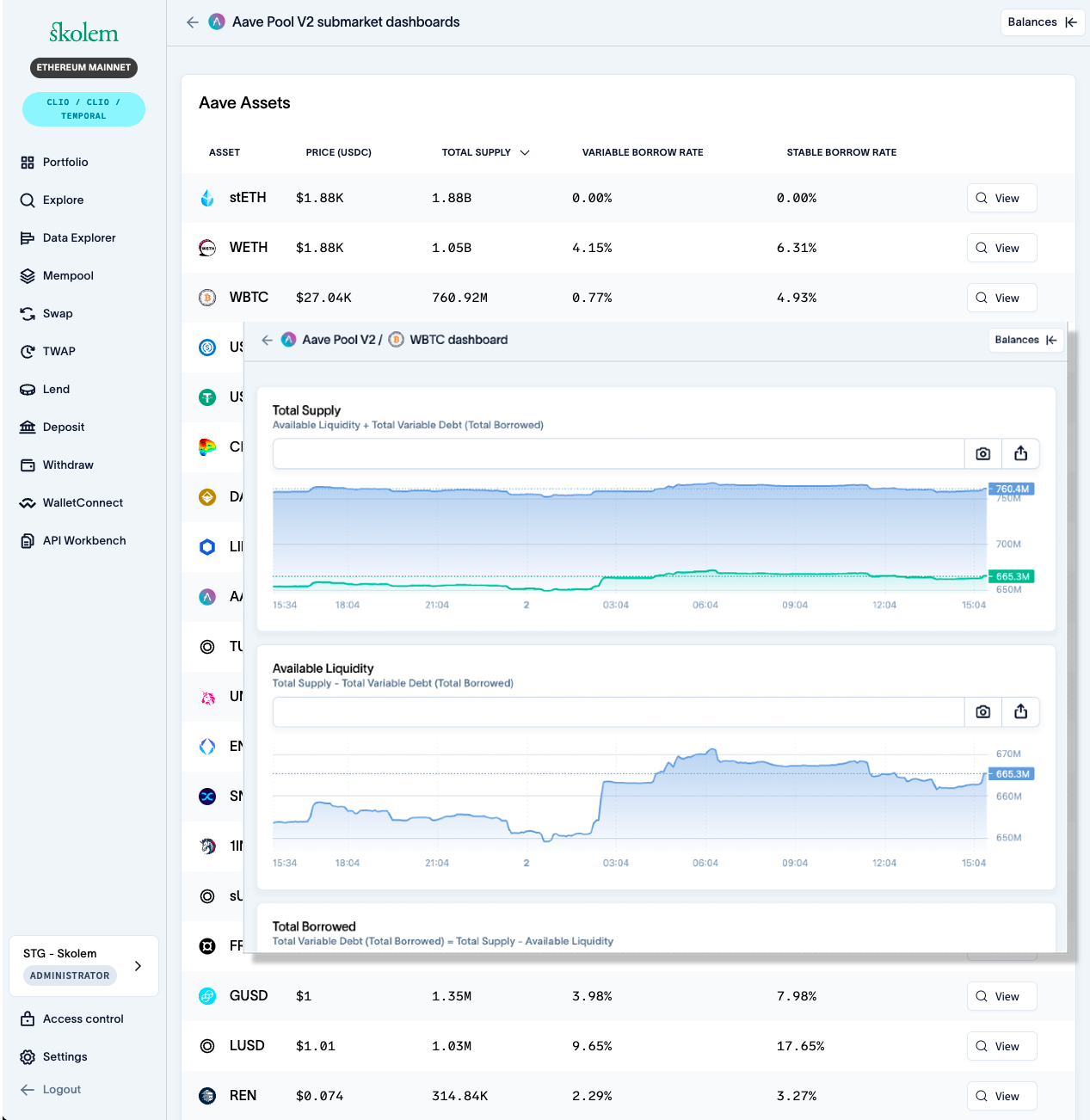

- We have also started to build dashboards for blue chip DeFi protocols directly on our front-end in order to provide our users with easy access to money market data! Users will be able to click into each submarket (e.g., WBTC) to access detailed historical and real-time data. As a reminder, all of this data is directly accessible via WebSocket and RESTful APIs. Skolem will start with AAVE V2 and expand to other markets based on client feedback.

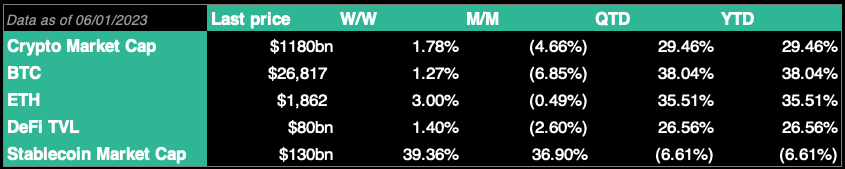

State of the Market

DeFi Yield Opportunities

These are some of the most interesting new yield opportunities surfaced by the Skolem team.

Any information covered in Skolem Segments should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions. Any mention of a token or protocol should not be considered a recommendation or endorsement.

[DAI] 6% APY with DAI by depositing DAI on Notional Finance

- Yield is earned in a fixed rate and earned in DAI

- To participate, deposit DAI into the DAI market

- Risk: Smart contract risk, bad debt risk, and interest rate risk exist for Notional Finance and is described further here

[CRV] 34% APY with CRV by depositing CRV on Yearn Finance

- Yield is auto-compounded and earned in staked yCRV

- To participate, deposit yCRV into st-yCRV, a Yearn v2 vault

- Risk: Smart contract risk and underlying third-party platform risk exist; CRV is a volatile token, which is subject to price risk

[ETH] 12% APY with ETH by depositing ETH on Origin

- Yield is auto-compounded and earned in OETH

- To participate, deposit ETH into OETH

- Risk: Smart contract risk and underlying third-party platform risk exist; ETH is a volatile token, which is subject to price risk

[LOOKS] 44% APY with LOOKS by depositing LOOKS on LooksRare

- Yield is auto-compounded and earned in LOOKS through the LOOKS Compounder, or users can earn LOOKS and WETH to receive 37% APY

- To participate, deposit LOOKS into the Compounder or Standard Method

- Risk: Smart contract risk exists; LOOKS and ETH are volatile tokens, which are subject to price risk

DeFi Developments

Institutional Adoption

- Zhengzhou City announces metaverse investment plan, launching a $1.4bn fund with an additional $7bn planned

- Platinum Group, the leading ticket issuer for Formula 1, releasing NFT race tickets starting with Monaco Grand Prix

- Ava Labs launches AvaCloud, a launchpad enabling companies to bring Web3 products to market faster

- Hong Kong Monetary Authority announces commencement of e-HKD Pilot Program, including programmable payments, tokenized deposits, settlement of Web3 transactions and tokenized assets

- Anchorage Digital enables Snapshot voting for its users to participate in on-chain governance

- Apple enables Axie Infinity on its App Store in a select number of countries

- Canton Network partners with BNP Paribas, Deutsche Bank, EquiLend, Goldman Sachs, and more to build a regulatory compliant blockchain

- WME to represent Pudgy Penguins as official talent agency after raising $9mm

- World Table Tennis announces inaugural international table tennis event partnership with Floki meme coin

- LG Electronics seeks patent for TV, which would allow users to trade NFTs

- The Federal Reserve's service FedNow (launching July 2023) will be available on Metal Blockchain

- Jane Street and Jump pull back crypto presence in the US - not to be mistaken for their continued international presence

- Sports Illustrated launches "Box Office" service, which includes an NFT ticket solution to let event hosts offer collectibles and loyalty benefits, on Polygon

- Government of Bhutan's investment arm DHI and Bitdeer Technologies seeking to raise $500mm for a mining fund

- Alibaba Cloud partners with Avalanche to lower barriers to launching metaverses

- Sotheby's Metaverse launches, offering a curated NFT marketplace on Ethereum and Polygon

- Coinbase launches institutional perps exchange, offering up to 5x leverage initially

Asset Tokenization

- Tokenized securities surpass $200mm market cap in the month of May

- Red Swan CRE, commercial real estate company with $5bn AUM, launching tokenization service on Hedera

- Securitize launches tokenized fund for Hamilton Lane to expand access to senior private credit

Regulatory

- Fred Wilson's VC firm Union Square Ventures to double down on Web3 investing, stating, "When they want to shut it down, I say double down"

- Hong Kong opens up retail trading for major cryptocurrencies on June 1st

- Coinbase Global extends services to Singaporean users amidst increasing acceptance while enabling no cost bank transfers

- CFTC Chair Rostin Benham shares that DEXs can be regulated by U.S. law during Bloomberg's Odd Lots podcast

- Bittrex files for bankruptcy protection less than a month after SEC sued it for operating an unregistered exchange

- Leading crypto institutions submit Comment Letters in regards to the SEC's Safeguarding Rule on crypto custody

- Biden ties Republicans with "wealthy crypto investors", continuing political debate over crypto

- State lawmakers are working on new legislation for digital assets amidst 2022's chaos

- U.S. Chamber of Commerce criticizes the SEC's enforcement approach to ETH, Coinbase, Kraken, and the broader industry

- NY Attorney General Letitia James introduces Crypto Regulation, Protection, Transparency, and Oversight (CRPTO) Act

- SEC removes 'digital assets' definition from hedge fund rules and is continuing to consider this term

Contact Us

If your team is interested in reaching out to the Skolem team, please email us at sales@skolem.com or reach out on our website at skolem.com.