If you’ve been following Skolem since its inception in 2020, you’re probably familiar with Ethereum and its significance in the blockchain era - and you’re also probably familiar with the high gas fees associated with transactions! Blockchain technology is affected by massive limitations in its scalability, which we will explore in more detail in this discussion.

Ethereum has positioned itself to become the de facto platform for decentralized application and smart contract development. Ethereum today stands as the second most valuable cryptocurrency by market capitalization and supports over one million transactions daily, a significant increase in adoption since it overtook Bitcoin’s daily transaction counts in June 2017 and when Ethereum was seeing only ~250k transactions daily. This adoption, however, comes at the cost of increased transaction fees, or gas prices.

Ethereum’s Scaling Problem

Etherscan Gas Data

During DeFi Summer of 2020 and the peak of the bull run in 2021, 30-day rolling average gas prices were as high as 200 Gwei, meaning some users of the Ethereum blockchain ended up paying hundreds of dollars to transact. In another bull market scenario, as the number of people using Ethereum has grown, the blockchain will reach certain capacity limitations.

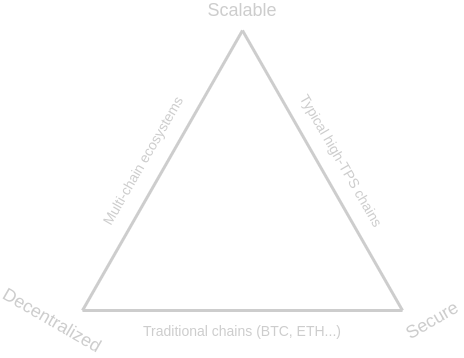

Ethereum’s scalability trilemma, as described in Vitalik blog, states that there are three properties that a blockchain aims to have:

- Scalability: the chain can process more transactions than a single regular node (eg., a consumer laptop) can verify

- Decentralization: the chain can run without any trust dependencies on a small group of large centralized actors

- Security: the chain can resist a large percentage of participating nodes trying to attack it

Vitalik further discusses the sharding technique, which will make Ethereum more scalable by increasing its transactions per second while decreasing the power needed to run a node and validate the chain. However, in its current inning, Ethereum’s design presents limitations to its scalability (e.g., high fees discussed above), but sidechains and Layer 2 blockchains have supported Ethereum’s trilemma by focusing on scalability. In order to unlock Ethereum’s full potential, these scaling solutions have come to market as promising solutions to support broader blockchain adoption.

Scaling Ethereum with Sidechains

Sidechains interact with Ethereum in two ways:

- Providing a mechanism for bridging assets from the Layer 1 to the respective sidechain.

- Posting snapshots or highly compressed summaries of all account balances of the sidechain network to Ethereum.

Sidechains have gained traction as an alternative way to access the many dapps that exist on Layer 1 blockchains. Polygon’s PoS sidechain is the most widely adopted solution to date, with more than 53,000 applications deployed on Polygon and ~$7bn of assets on its platform.

TokenTerminal User Data

Monthly active users on Polygon crossed 5 million users in October of 2022, exceeding Ethereum’s MAUs. Arbitrum, a Layer 2 rollup scaling solution discussed below, has gained significant traction as well and is catching up quickly.

Scaling Ethereum with Layer 2 Solutions

Layer 2 is a collective term for Ethereum scaling solutions, which serve as protocols built on top of Ethereum with the aim of enhancing scalability while taking advantage of its security. Layer 2 networks function by processing transactions off of the supported Layer 1, thus relieving the Layer 1 network from computational burden; these transactions are executed in a separate environment, where they are verified prior to being committed back to the main chain, like Ethereum. This harmonious relationship allows Layer 1s to handle security, data availability, and decentralization, while Layer 2s can handle scaling. The different types of Layer 2 solutions include plasma, optimistic rollups, zero-knowledge rollups, and validium; no one scaling solution is enough to achieve Ethereum’s vision.

Rollups in Ethereum’s current stage have seen significant adoption as the premier scaling solution for Ethereum. By using rollups like Arbitrum, users can reduce their transaction fees paid towards gas by up to 100x. These rollups will “roll up” and batch transactions into a single transaction on Ethereum, distributing the fees from the Layer 1 across everyone in the rollup and making it cheaper for each user.

In 2022, Layer 2 blockchains accounted for ~1.5% of the fees paid on Ethereum, but with the launch of new L2s like Arbitrum and Optimism, this 30-day rolling average has grown to nearly ~7% in 2023, as shown below.

a16z State of Crypto Report

As scaling solutions for Ethereum present promising new paths to adoption, we can expect to increase transaction throughput, lower transaction costs, and see an increasing share of fees paid by L2 rollups, as shown above. Ultimately. by posting transactions on Ethereum, rollups maintain and maximize their inheritance of Ethereum’s underlying security. Rollups like Arbitrum can increase transaction throughput and drive down fees by compressing this transaction data and spreading the cost of L1 transactions in batches of transactions.

Sidechains vs Layer 2 Rollups

The distinction between Layer 2 rollups and sidechains are in how their bridging smart contracts function. With sidechains, bridge contracts assume transactions on the sidechain are valid; users need to trust that Polygon’s validators will not collude or be subverted such that a user’s funds could be drained from the sidechain bridge smart contract. With Layer 2 networks, bridge contracts do not make this assumption and can verify transactions executed on the Layer 2, like Arbitrum, are valid per the rules of Ethereum (i.e., validation is achieved by proving systems such as fraud proofs and validity proofs).

Challenges and Roadmap Ahead

Considering all the early success in enhancing Ethereum’s scalability, several challenges still exist for these scaling solutions. The primary barriers we will need to overcome span across user experience and interoperability. Bridging takes time and resources upfront to move assets from Ethereum to its respective Layer 2s. Furthermore, the workflow in DeFi today is highly manual with several pain points across onboarding that aren’t necessarily immediately clear. In regards to interoperability, the proliferation of dapps with composability in mind will allow users to also easily build on top of existing products for blockchain and DeFi use cases, contributing to a flywheel of user and protocol adoption. Improving dapp composability will take time, even as these platforms are EVM-compatible.

With transaction fees on L1s remaining high and presenting barriers to adoption, there is an increased focus on facilitating a move towards rollups. As discussed today, rollups like Arbitrum provide lower fees for users, but even this reduction in fees can present barriers to adoption for a wider user base.

In terms of Ethereum’s roadmap, all eyes are on EIP 4844, which will introduce a new transaction format in preparation for “blob-carrying transactions,” which will be used in data sharding. EIP 4844 will reduce the cost of rollups and increase transaction throughput without compromising security and decentralization; if rollups helped scale Ethereum, then EIP 4844 will even help rollups to scale Ethereum further.

If you're interested in executing on Polygon or Arbitrum today, don't hesitate to reach out to sales@skolem.com. Skolem now supports Ethereum, Polygon, Arbitrum, and Avalanche!