Welcome to Skolem Segments, a newsletter where our team shares updates to the business and interesting DeFi opportunities and developments. If you're new here, we're excited to welcome you to our Segments for our monthly updates.

Skolem Announcements

- Skolem users are now able to execute and route swaps through more aggregators! Skolem is excited to share that we have successfully integrated OpenOcean and ParaSwap into our DEX aggregator, which also includes 0x/Matcha and Uniswap.

- Users can now track collateral and borrow balances, health factor / loan health, and more for any wallet address in our Money Markets Tracker template! Users will also be able to track metrics such as available liquidity and supply/borrow rates for tokens across Aave v2 (Ethereum), Aave v3 (Ethereum, Polygon), Compound v2 (Ethereum), and Compound v3 (Ethereum). Note: We are actively rolling out more support for metrics and submarkets across these protocols!

Insert any wallet address at any Excel-friendly date and time to begin tracking your positions

- If you’re interested in executing through Skolem and tracking your open loan positions with high granularity (historically and in real-time), please don’t hesitate to reach out to adam@skolem.com for an API key and trial!

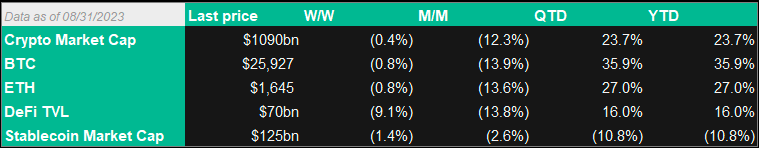

State of the Market

DeFi Yield Opportunities

These are some of the most interesting new yield opportunities surfaced by the Skolem team.

Any information covered in Skolem Segments should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions. Any mention of a token or protocol should not be considered a recommendation or endorsement.

[CRV] 26% APY with CRV by depositing CRV on Yearn Finance

- Yield is auto-compounded and earned in staked yCRV

- To participate, deposit yCRV into st-yCRV, a Yearn v2 vault

- Risk: Smart contract risk and underlying third-party platform risk exist; CRV is a volatile token, which is subject to price risk

[USDC/USDR] 28% APY with USDC and USDR by depositing stables on Pearl

- Yield is earned in PEARL

- To participate, supply USDC and USDR into the Pearl USDC-USDR pool

- Risk: Smart contract risk exists for dapps like Pearl; PEARL is a volatile token, which is subject to price risk

[MATIC/USDR] 47% APY with MATIC and USDR by depositing MATIC and USDR on Pearl

- Yield is earned in PEARL

- To participate, supply MATIC and USDR into the Pearl MATIC-USDR pool

- Risk: Smart contract risk exists for dapps like Pearl; PEARL is a volatile token, which is subject to price risk

[WETH] 20% APY with WETH by depositing WETH into the Sturdy pool

- Yield is earned in WETH

- To participate, deposit WETH into the Sturdy WETH market

- RIsk: Smart contract risk exists for dapps like Sturdy; WETH is a volatile token, which is subject to price risk

DeFi Developments

Institutional Adoption

- Singapore’s biggest bank DBS unveils “DBS BetterWorld” metaverse experience for reducing food waste

- Coca-Cola launches "Masterpiece" NFT collection on L2 Base, featuring classic and modern artworks from the brand

- Take-Two (developers of Grand Theft Auto) subsidiary Zynga plans to launch first Web3 game Sugartown after an initial 10k collection mint

- Leading Korean mobile carrier SK Telecom partners with Polygon Labs to develop Web3 technology and incubate startups

- PayPal launches U.S. Dollar st ablecoin named PayPal USD (PYUSD), which is backed by U.S. dollar deposits and short-term U.S. treasuries

- Microsoft partners with L1 Aptos in order to train Microsoft's AI models using Aptos' blockchain; Aptos will also run validator nodes for its blockchain on Microsoft's Azure cloud

- Gamestop terminates service of crypto wallets due to regulatory uncertainty

- Revolut terminates US crypto services, citing "regulatory environment"

- Bybit launches Bybit Wealth Management as derivatives volumes decline across centralized exchanges

Asset Tokenization

- Securitize acquires Onramp Invest, extending access to tokenized alternative assets

- Courtyard NFT, a tokenization service and marketplace, launches and reveals upcoming drop with Pokemon cards

Regulatory

- Grayscale has secured a second landmark win for the crypto industry against the SEC, likely clearing the path for a spot Bitcoin ETF

- Tornado Cash founders charged with money laundering and sanctions violations

- Treasury, IRS release proposed rules that would require exchanges and brokers to increase tax reporting

- U.S. DOJ is investigating Binance for potential violations of U.S. sanctions against Russia

- Bitget requires mandatory KYC as more exchanges require ID verification and expand globally

- SEC charges fintech company Titan Global Management for misrepresenting hypothetical performance results as high as 2700%

- SEC is unlikely to block Ether-Futures ETFs that could list by October

- Senator Lummis, who recently introduced a bill to regulate digital assets with Sen. Gillibrand, joins call to dismiss the SEC's case against Coinbase

- Crypto custodian Prime Trust and some of its affiliates filed for Chapter 11 bankruptcy protection

- Worldcoin suspended in Kenya due to the government's concerns with user registration

- Blockchain.com receives major payment institution license from Monetary Authority of Singapore

- Uniswap removes HEX token from its interface after it was called an unregistered security by the SEC

- Hong Kong's new crypto regime awards first exchange license to HashKey

Contact Us

If your team is interested in reaching out to the Skolem team, please email us at sales@skolem.com or reach out on our website at skolem.com.