Welcome to Skolem Segments, a newsletter where our team shares updates to the business and interesting DeFi opportunities and developments. If you're new here, we're excited to welcome you to our Segments for our monthly updates.

Skolem Announcements

- Skolem is now offering an updated execution API that allows you to access more markets and orders with easy-to-use ergonomics! Please reach out at sales@skolem.com if you would like to test the new version.

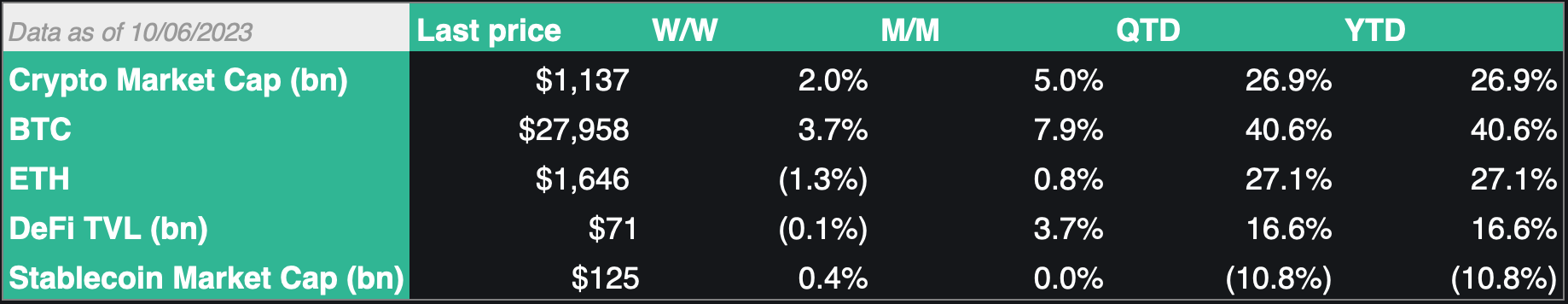

State of the Market

DeFi Yield Opportunities

These are some of the most interesting new yield opportunities surfaced by the Skolem team.

Any information covered in Skolem Segments should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions. Any mention of a token or protocol should not be considered a recommendation or endorsement.

[cbETH, ETH] 10% APY with cbETH and ETH by depositing these tokens into LP vault on Beefy Finance

- Yield is earned from liquidity provisioning with cbETH and ETH - currently boosted by Alienbase

- To participate, supply USDC and USDR into the cbETH-ETH LP vault

- Risk: Smart contract risk exists for dapps like Beefy Finance and Alienvault; impermanent loss may also occur from LPing

[CRV] 24% APY with CRV by depositing CRV on Yearn Finance

- Yield is auto-compounded and earned in staked yCRV

- To participate, deposit yCRV into st-yCRV, a Yearn v2 vault

- Risk: Smart contract risk and underlying third-party platform risk exist; CRV is a volatile token, which is subject to price risk

[USDC, USDR] 21% APY with USDC and USDR by depositing stables on Pearl

- Yield is earned in PEARL

- To participate, supply USDC and USDR into the Pearl USDC-USDR pool

- Risk: Smart contract risk exists for dapps like Pearl; PEARL is a volatile token, which is subject to price risk

[LINK, WETH] 29% APY with LINK and WETH by depositing these tokens as LP pair on Uniswap v3

- Yield is earned from liquidity provisioning with LINK and WETH

- To participate, supply LINK and ETH into the LINK-WETH 0.3% pool

- Risk: Smart contract risk exists for dapps like Uniswap; LINK and WETH are volatile tokens, which are subject to price risk

DeFi Developments

Institutional Adoption

- Walmart and Pudgy Penguins announce partnership to debut toy collection across 2,000 stores and online

- Busan, Korea’s second largest city, plans to launch digital assets exchange for trading commodities

- Deutsche Bank and Taurus partner to offer digital asset custody and tokenization services

- PayPal USD (PYUSD), an on-chain, regulated, dollar-denominated stablecoin 100% backed by U.S. dollar deposits, short-term U.S Treasuries, and similar cash equivalents, is now available on Venmo

- Google Cloud joins Polygon’s network as one of its decentralized validators

- The Bank of Korea (BoK) plans to begin a wholesale central bank digital currency (CBDC) test in partnership with the Bank for International Settlements (BIS) and other institutions

- Swift shares that three central banks are beta testing its CBDC interoperability project

Asset Tokenization

- MakerDAO explores proposal to allocate $100mm to develop tokenized T-Bill products

Regulatory

- U.S. prosecutors from the DOJ state current laws are sufficient to charge SBF for alleged fraud

- Celsius successor to be seeded with $450mm in crypto if restart plan approved

- Valkyrie wins nod to add Ethereum futures to ETF as SEC delays Bitcoin call

- CFTC continues enforcement focus in DeFi by filing and settling charges against Opyn, ZeroEx, and Deridex for offering illegal digital assets derivatives trading

- Federal Reserve releases paper outlining tokenization and its potential benefits and financial stability implications

- CFTC charges Mosaic Exchange Limited with fraudulent solicitation and commodities trading scheme

- Ripple obtains digital asset license from Monetary Authority of Singapore

- Binance.US Head of Legal and Chief Risk Officer depart while the exchange is under intense pressure from regulators

Contact Us

If your team is interested in reaching out to the Skolem team, please email us at sales@skolem.com or reach out on our website at skolem.com.