Smart contract developers leverage oracles across a gamut of blockchain use cases in order to pull data about assets and markets. For DeFi developers and the on-chain ecosystem, applications like Aave, Synthetix, dYdX, Compound, and more use oracles to determine participants' borrowing capacity, verify loan health, and provide constant pricing feeds. For example, protocols like Synthetix that develop synthetic products to provide on-chain exposure to oil will leverage Chainlink oracles to maintain price feeds for sOIL, a synthetic digital asset tied to a non-expiring Crude Oil Price index.

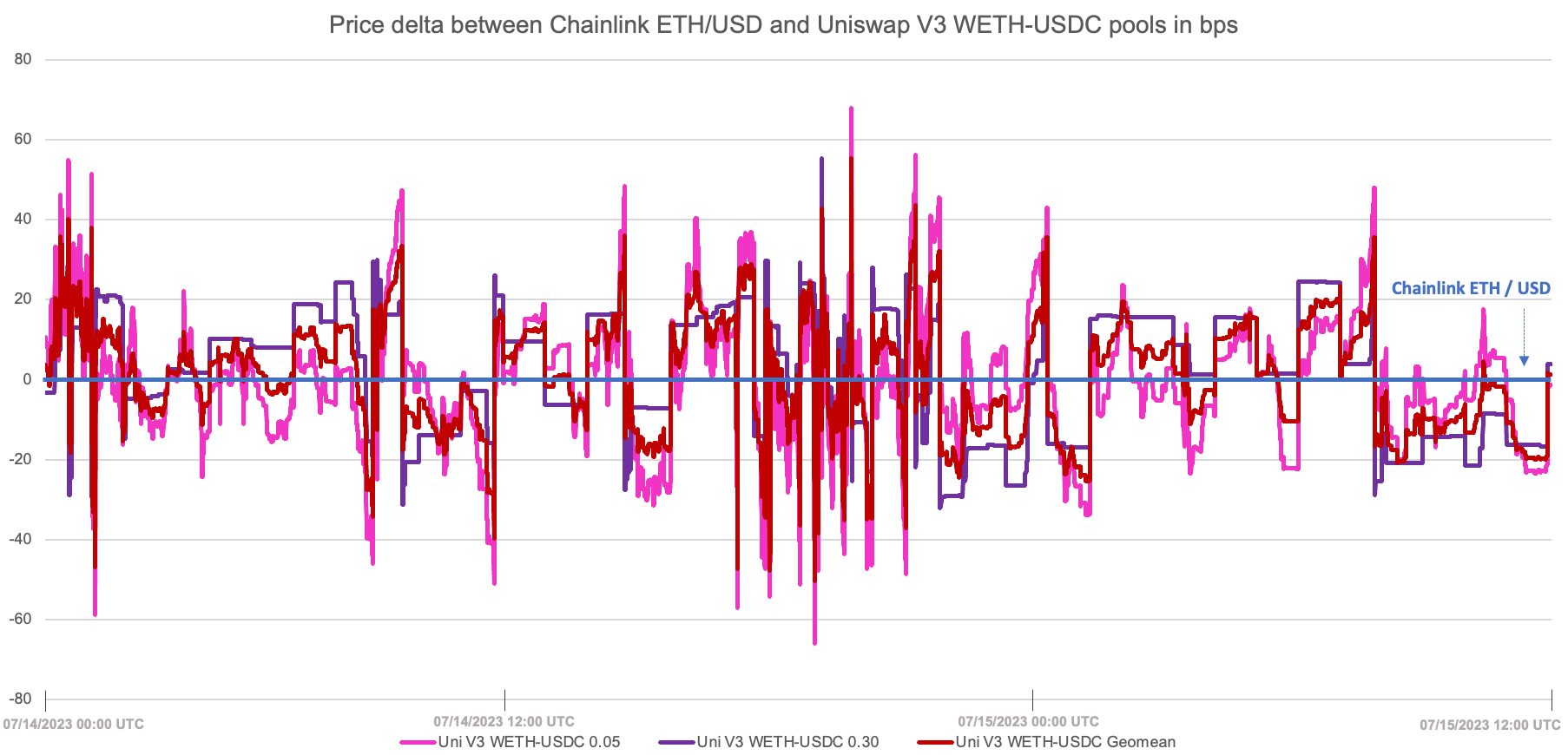

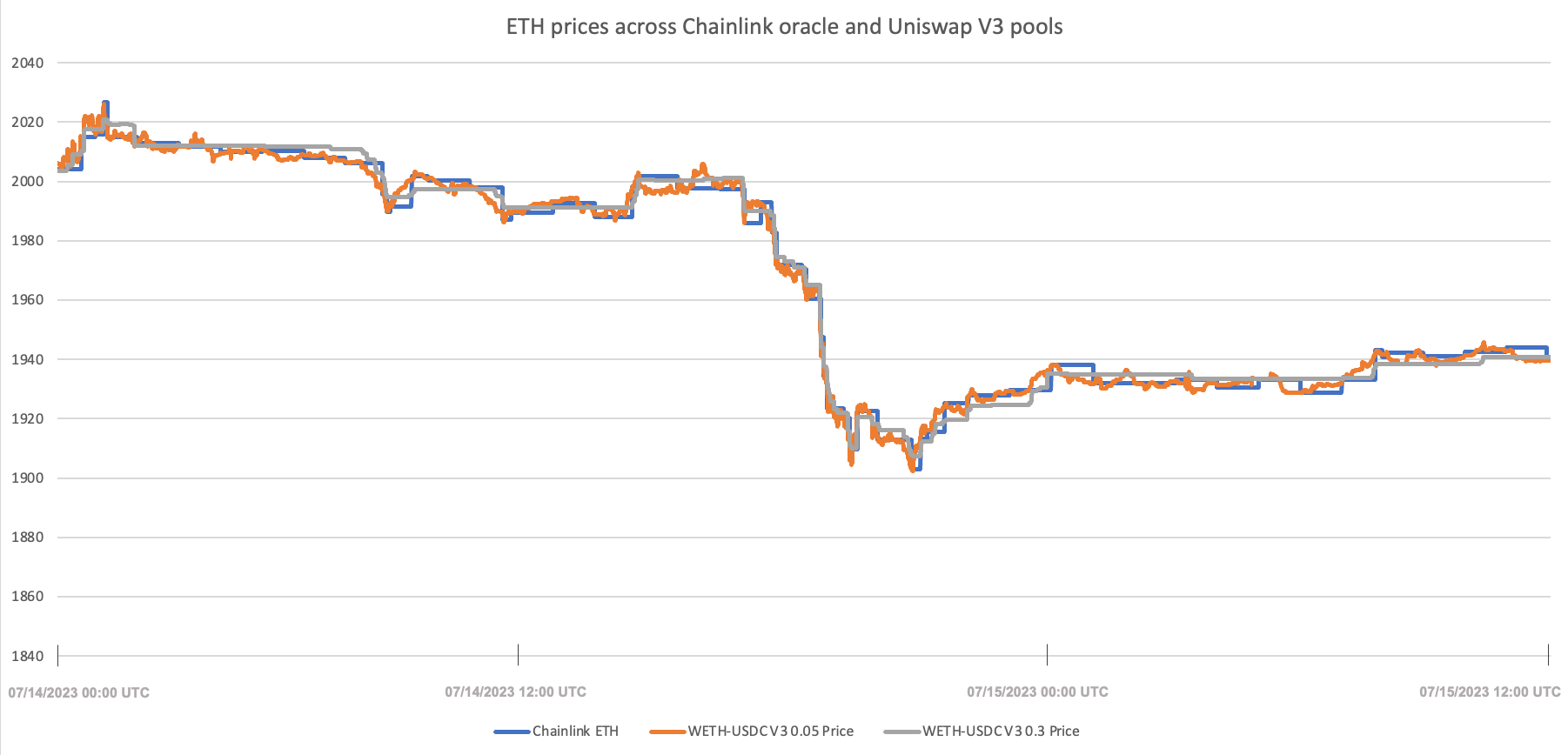

In contrast, Uniswap v3 pools can also serve as oracles, offering access to historical price and liquidity data as long as participants are able to stream and pull the on-chain pricing data. Utilizing Skolem's Temporal data product, the team was able to identify discrepancies in Ethereum / ETH pricing between Chainlink's price feed and live, on-chain pricing directly from Uniswap v3 pools (0.05% fee pool and 0.30% fee pool).

Data from Skolem Temporal Excel Add-in pulled from 07/14/23 00:00 UTC to 07/15/23 12:00 UTC (36 hours)

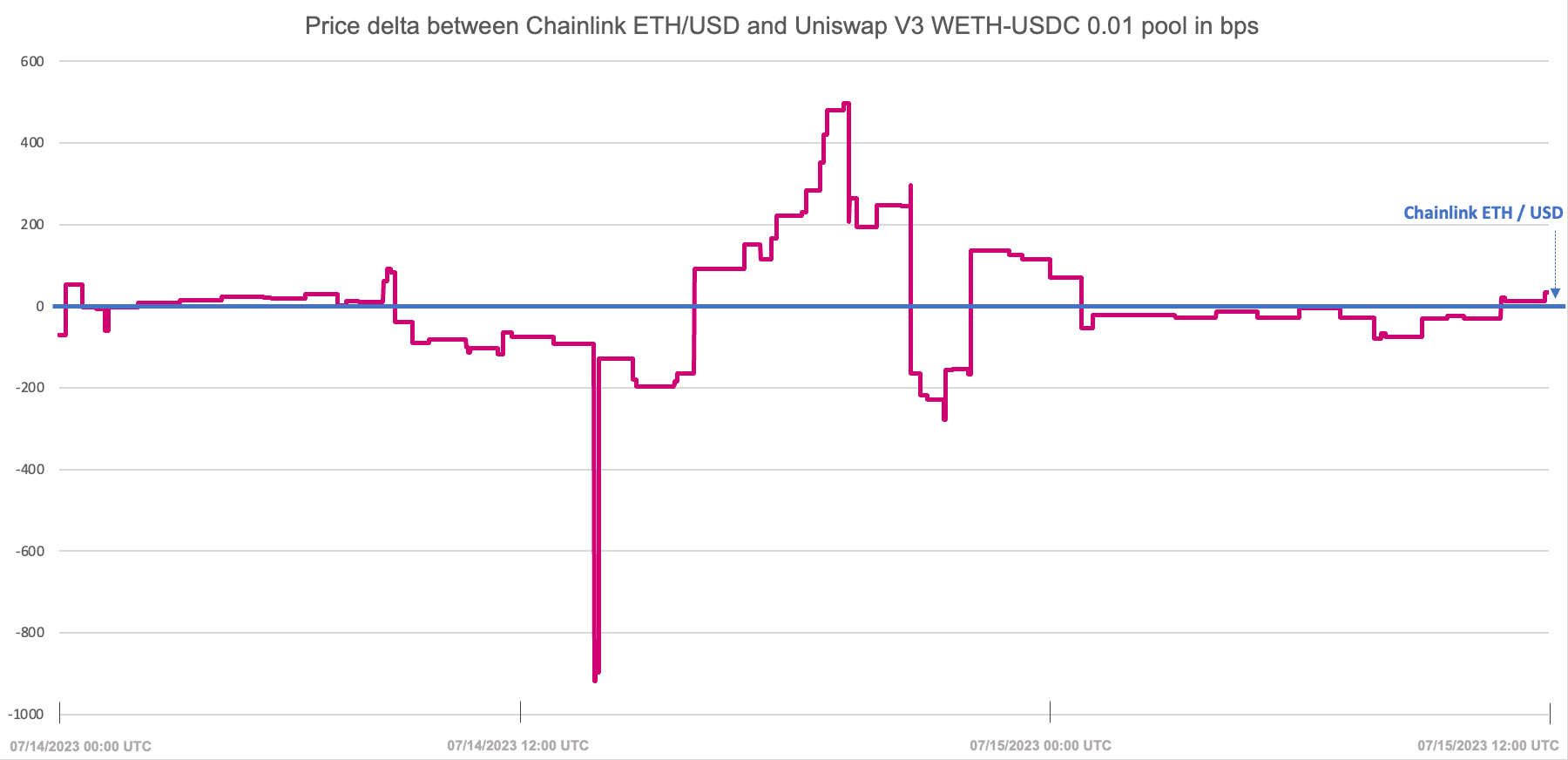

This discrepancy in pricing between Chainlink and Uniswap is particularly more pronounced during times of volatility, especially for lower fee tier liquidity pools that attract less liquidity due to lower fees for liquidity providers.

As we can see between 07/14/2023 at 12:00 UTC and 07/15/2023 at 00:00 UTC, the discrepancy for pools with deeper liquidity (e.g., 0.05% and 0.30% fee pools) ranges between -66bps and 68bps during heightened times of volatility. This divergence in price is even more pronounced in the 0.01% fee pool, which has attracted <$100k in liquidity; the pricing delta ranges from -918bps to 498 bps as liquidity is thin in the 0.01% pool.

During the time range between 07/14/2023 12:00 UTC and 07/15/2023 00:00 UTC pulled using Skolem's on-chain data tool, we can see that the discrepancy described above became more evident with increased volatility, exemplified when the price of ETH began to drop from the $2,000+ range back down to the low $1,900's last week during the same time period.

This relationship between oracle and pool pricing is important to keep in mind as we think about the impact of oracles in the industry. Although Chainlink oracles remain incumbent, leading players for providing on-chain pricing, going directly to the source (e.g., Uniswap V3) for markets can provide differing answers in regards to pricing data.

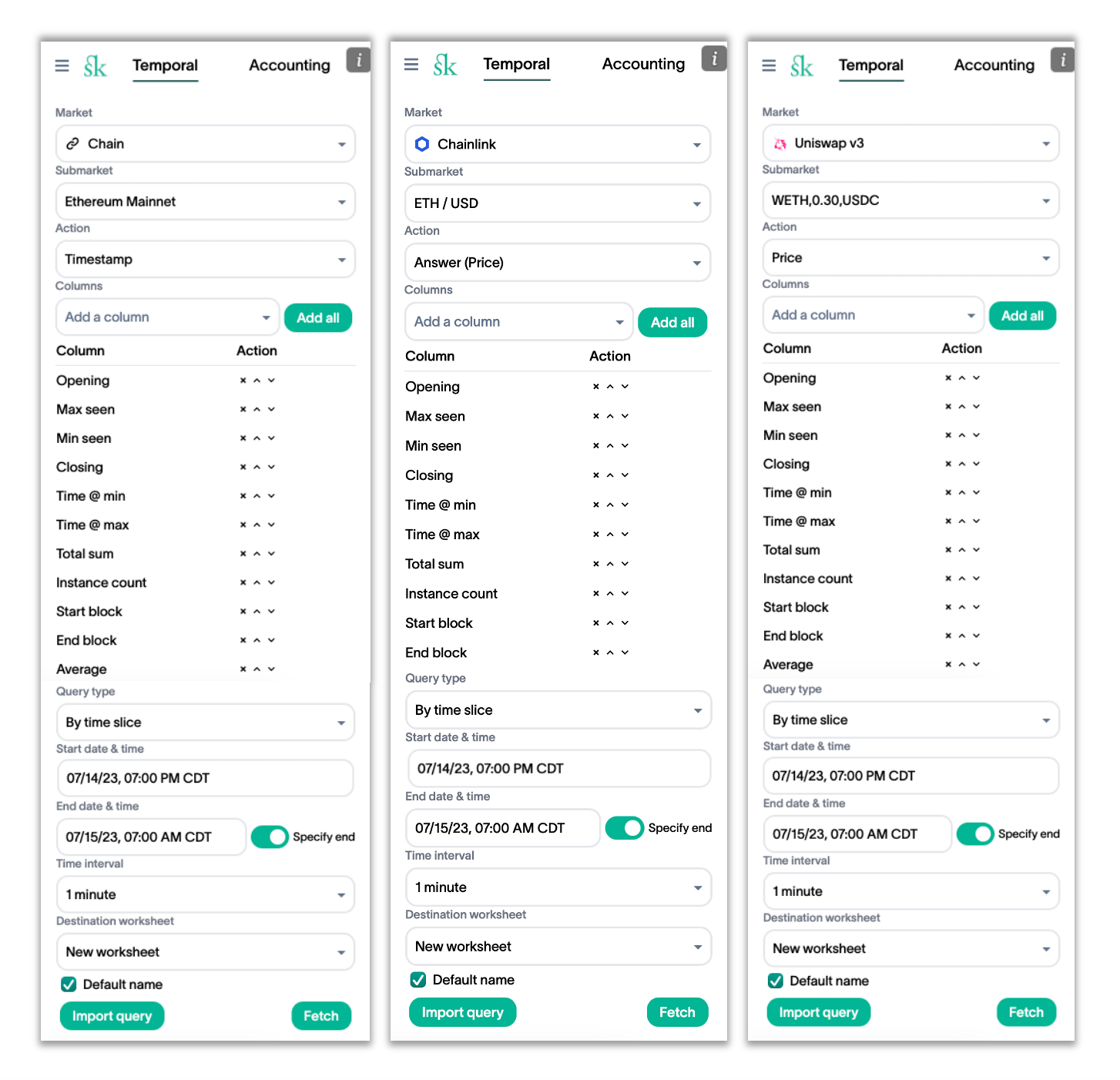

The Skolem team was able to gather this data using the proprietary Excel Add-in, which allows users to more easily access our on-chain data that is already available through our APIs. Using the "Chain" market, the team was able to pull Ethereum blocks based on unix timestamps between July 14th, 2023 and July 15th, 2023 during the period of high volatility. Using the "Chainlink" market, the team was then able to pull ETH / USD pricing in order to compare it to the on-chain WETH-USDC pricing for the 0.01%, 0.05%, and 0.030% pools in the "Uniswap v3" market.

Screenshot of Skolem's Excel Add-in, directly accessible through Excel workbooks

It remains critical to maintain multiple data sources in order to triangulate between various data feeds as funds and market participants execute on-chain and search for high-fidelity data across decentralized finance markets.

If you're interested in learning more, please don't hesitate to reach out to sales@skolem.com or request a demo on our website at skolem.com.